dependent care fsa vs tax credit

Estimate your expenses carefully. Do you know about the changes to the Dependent Care FSA and the Dependent Care Tax.

Sterling Administration Year End Hsa And Fsa Tips And Reminders Claremont Insurance Services

The expense limits are now 8000 for one dependent and 16000 for two dependents or more.

. Dependent Care FSA. How it works on the IRS Form 2441 and how they save yo. I know its been asked before several times for past years but Im so confused on which is correct for my family.

The child and dependent. I think the calculators I was using. Dependent Care FSA vs Dependent Care Tax Credit.

You have another option for saving money on dependent care expenses via lowering your taxable income. Theres also no income taxes to save on. The maximum credit was 35 of eligible expenses resulting in a credit of 1050 and 2100 against total tax liability.

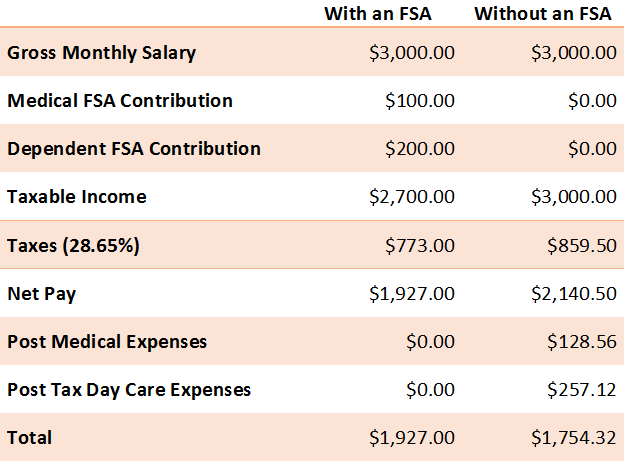

The FSA saves you 20 state tax rate in taxes on 5k the credit returns 50 of expenses though expense amount is reduced by whatever you pay through the FSA. The annual maximum pre-tax contribution may not exceed 5000 per year regardless of number of children. Use the charts below to help determine which option is best for you.

Child Care Tax Credit. Dependent Care FSA vs. Enter your expected dependent care expenses for the year ahead.

If you pay more than 6000 in childcare costs dont use the dependent care FSA take the credit. The 35 maximum credit applied to tax See more. The percentage depends on your adjusted.

If you pay 6000 - 11000 in childcare costs you could put the difference. Unlike the dependent care FSA however. 2023 Dependent Care FSA vs.

Dependent Care Tax Credit. The credit rate you can claim based on your income has increased. Dependent Care FSA vs.

The Child and Dependent Care Credit a tax credit for parents and other caregivers with qualifying dependents was expanded by more than double thanks to 2021s American Rescue Plan. Dependent Care Spending Account. Child and dependent care tax credit.

The amount of the credit is a percentage of the amount of work-related expenses you paid to a care provider for the care of a qualifying individual. The dependent-care tax credit can help if you dont have an FSA at work. You can set aside up to 5000 in pretax money in your FSA then claim the dependent-care credit for up.

You can save 1935 plus state taxes on 5k with the fsa and 20 on only 3k with the tax credit. But 2022 reverts back to the fsa being better. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents.

Today we discuss how the Dependent care FSA affects the child and dependent care tax credit for 2022. Dependent Care Tax Credit vs. As for FSA vs tax credit - you dont pay any federal income tax and the child care tax credit isnt refundable so you wont get any benefit from that.

The child and dependent care tax credit covers similar expenses as the dependent care FSA. Keep in mind that each persons tax situation is unique. 5000 is the maximum whether for one child or.

Due to the IRS use it or lose it rule you will forfeit any money remaining in your 2020. Both the dependent FSA and child and dependent care tax credit provide tax advantages but they calculate their respective tax.

Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

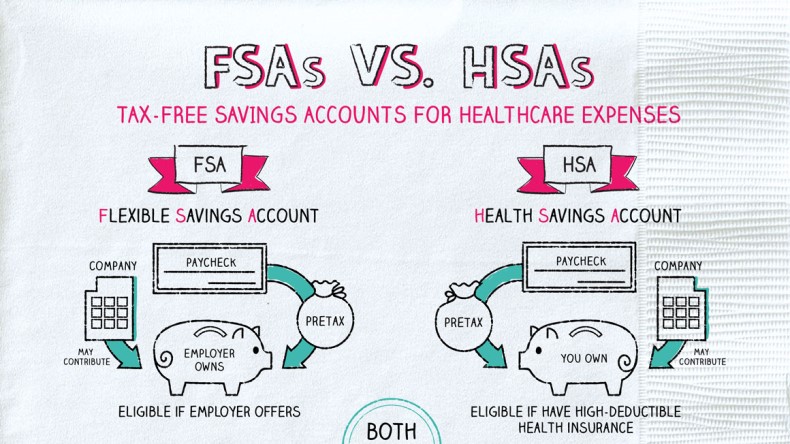

What Are Fsas Vs Hsas Napkin Finance

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

Dependent Care Fsa Vs Dependent Care Tax Credit Finstream Tv

Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Dependent Care Savings Account And Tax Credits C D Llp

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

What Is A Dependent Care Fsa Dcfsa Paychex

What Is A Dependent Care Fsa Family Finance U S News

2021 Dependent Care Fsa Vs Dependent Care Tax Credit Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Irs Offers Overview Of 2021 Tax Provisions In American Rescue Plan Nstp

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Changes To Dcfsa Cdctc White Coat Investor